Gov. Mike Parson has signed a bill lowering Missouri's personal income tax rate from 5.9 percent to 5.5 percent Jan. 1.

House Bill 2540 allows personal income tax rates to drop further to 5.1 percent if the state hits revenue targets in years to come.

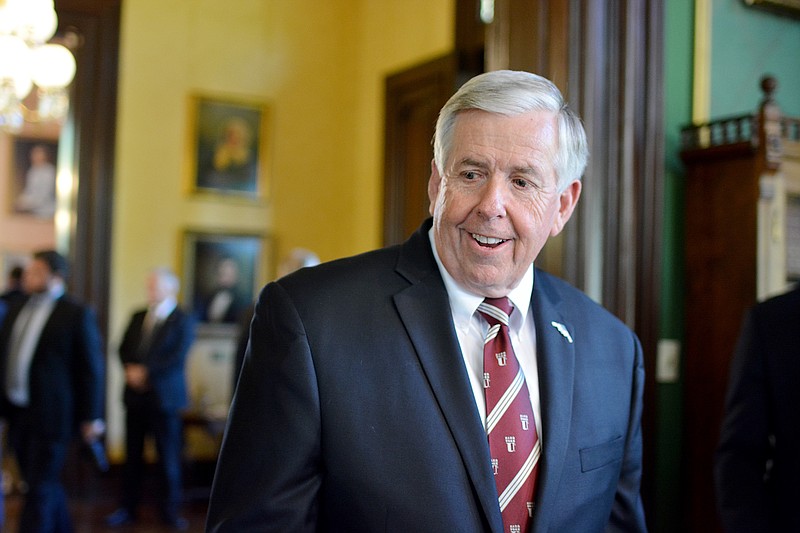

Parson signed the bill Thursday at an event in Springfield. The governor said in a news release this development begins a long process to update the state's tax code.

"This is only the beginning of our plan to keep more money in the pockets of Missourians and Missouri small businesses," Parson said. "I look forward to working with the Legislature long term to identify ways to continue to offer broad-based tax relief."

A tax cut passed by the Missouri General Assembly in 2014 already caused personal income taxes to fall from 6 percent to 5.9 percent after the state hit revenue targets, Missouri State Treasurer Eric Schmitt noted in a statement Wednesday. Revenue growth will trigger another cut from the current 5.9 percent rate to 5.8 percent in January, Schmitt confirmed.

The new law Parson signed Thursday will bring the rate down 0.4 percent, taking it gradually down to 5.1 percent depending on revenue growth, the Associated Press reported.

The General Assembly passed the income tax cut in the waning days of the 2018 legislative session. When fully implemented in 2023, it will result in a $5.8 million drop in revenue for the state, according to the AP. To offset the loss, the bill phases out a federal income tax deduction of up to $5,000 for individuals and up to $10,000 for married couples who file jointly.

The Missouri Budget Project, a non-partisan Jefferson City-based think tank, estimated the bill will generate an additional $60 million annually and close several other loopholes.

Before he left office in June, former Gov. Eric Greitens signed a separate bill lowering the corporate tax rate from 6.25 percent to 4 percent.

State Rep. Elijah Haahr, R-Springfield, sponsored HB 2540 in House.

"This is a big step forward in modernizing our tax policy and making Missouri a more competitive state for individuals and businesses," Haahr said in a news release.