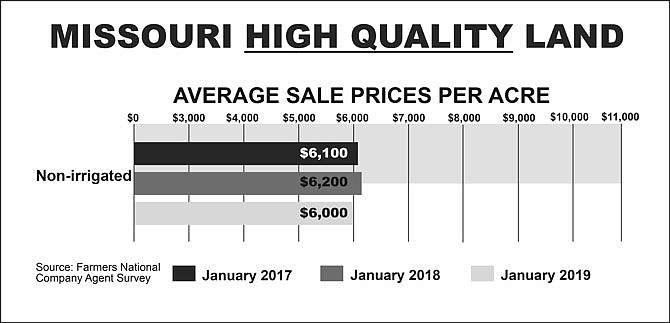

Values for quality farmland continue to hold fairly steady across the eastern Corn Belt, including Missouri and nearby states.

This is according to data collected by Farmers National Company, a firm that includes real estate services in agriculture.

"At Farmers National Company auctions, we are seeing good bidding for quality land in the more competitive areas. Farmer buyers still have the financial ability to make land purchases along with continuing investor interest in this region," area sales manager Roger Hayworth said.

He was addressing land sales in Illinois, Indiana, Ohio, Michigan, Missouri and Arkansas. The supply of land for sale in the region has been lower for several years, helping support steady prices. There is an increase in private transactions by farmers wanting to trade into a better farm, but few are for financial reasons.

"These behind-the-scene sales tend to be a lower price than if the land was fully exposed to the open market," Hayworth said.

Buyers are becoming more cautious when they are contemplating a land purchase. Lower quality land prices continue to see more pressure, as there is not the demand for farms that are less productive or efficient to farm.

Looking ahead, Hayworth said he sees the potential for pressure on land prices.

"The uncertainty of commodity markets, pending government and global issues, and the expected rise in interest rates are challenging agriculture right now," he added. "We may see stable to slightly lower land prices over the next six months depending on what happens with any or all of the factors affecting ag. It becomes more important than ever to have an experienced company like Farmers National Company to market and sell land during times like this."

Factors outside agriculture are hanging over the land market and may have a further effect on values. Landowners, lenders and producers are watching interest rates and wondering how high they might go. Higher rates not only affect borrowing costs, but also influence capitalization rates for land investors. Those in agriculture are concerned about the current trade issues and if there will be lingering effects. On the positive side, small and large investors continue to be interested in owning agricultural land for the long-term, senior vice president of real estate operations Randy Dickhut said.

"The overriding question in the land market is about supply and demand," he said. "At this time, there are enough buyers at most sales to bid up the price to a good level for the seller. But as we move ahead over the coming months, will buyers become even more cautious than they are now while at the same time will we see more land come up for sale for various reasons? All of this is why those involved in the land market, from owner to lender, are holding their breath to see what comes over the next year."