The Callaway County assessor's office has sent nearly 8,000 notices of increased assessment values during the past month, Assessor Jody Paschal said.

The last round of reassessments completes a process begun last year, after the county was notified it was out of compliance with the State Tax Commission. Properties in the county were selling more than 10 percent higher than their assessed market value.

"Last year, we had a mandatory reassessment of Callaway County due to our values being too low," Paschal said.

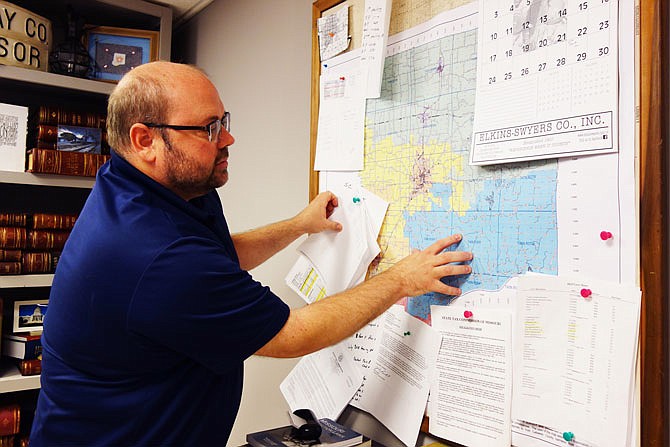

The first round covered about 60 percent of Callaway County properties and was focused in the northern half of the county. The second round included the remaining 40 percent, centered in the South Callaway School District and Holts Summit areas.

"We looked at every parcel," Paschal said Wednesday.

The southern part of the county included about 11,500 parcels of land containing residential and agricultural properties. Based on data provided by the assessor's office, 70 percent saw some kind of uptick in assessed value - a higher percentage than in the northern half, where only 40 percent increased in value. Paschal said it had been longer since properties in the southern part of the county were reassessed.

The amount by which properties increased varied widely, Paschal said.

"Older homes went up considerably because they had not been assessed in a long time," he said.

Assessors look at many factors when determining the value of a home, from age to condition to square footage to number of bathrooms. Using software helps control for human error. However, Paschal said, mistakes aren't impossible.

"They just need to call the office, and we'll go over the data," he said. "A current appraisal helps."

Paschal can be visited at his office in the lower level of the Callaway County Courthouse.

Residents may appeal to the Callaway County Board of Equalization, which will meet in the Callaway County Commission office in the courthouse beginning July 2. Board members include commissioners Gary Jungermann, Randy Kleindienst and Roger Fischer; county Auditor Karen Rentschler; real estate agent Joan Berry Morris; Julia Uhls; county Assessor Jody Paschal; and Denise Hubbard, board secretary and county clerk.

Residents should call the county clerk's office at 573-642-0730 no later than July 9 to schedule an appointment.

Paschal said he sympathizes with people worrying about higher tax bills, but correcting outdated assessments is part of his job and is required by the State Tax Commission.

"In '08 when the markets took a big dip, our values were so low that they weren't even affected," Paschal said.

Following the first round of reassessments, he added, data showed properties in the affected area were selling at an average of $10,000 more than their assessed value - though still within the margin required by the State Tax Commission. Paschal said he'd rather be under than over.

With this overdue countywide reassessment complete, regular assessments conducted every other year should yield more modest changes.

"Now we can actually monitor the market," he said.